In the food & beverage industry, gut feelings don’t cut it anymore.

Data-driven insights are your secret ingredients to improving your CPG ecommerce marketing and CRM strategy, and delivering what your customers crave.

Klaviyo’s 2024 state of ecommerce report found that 63% of surveyed food & beverage companies generated higher profits over the last 12 months.

But concern about inflation and higher prices is eating away at customers, with 59% of consumer survey respondents anticipating spending more money on food & beverage products.

Get a bite-sized taste of the 2024 state of ecommerce report with the 4 insights below. This snapshot of what’s shaping the food & beverage industry should help you make smarter decisions about everything from pricing to marketing strategies.

Insight 1: Food & beverage customers shop weekly

Our data reveals that almost all surveyed consumers (95%) buy food & beverage products at least weekly—and 15% do so every day.

This trend means your CPG ecommerce business has regular touchpoints with your customers—and frequent opportunities to engage and sell.

How to use this insight to thrive in the food & beverage industry

Apply the power of routine by aligning your marketing efforts with your customers’ weekly shopping habits.

Let’s say you run a premium snack brand. Your data shows that most of your customers shop on Sunday evenings, likely preparing for the week ahead. You create a marketing campaign called “Sunday Snack Prep.”

- Every Sunday at 4 p.m., you send an email showcasing a curated selection of snacks perfect for the workweek, personalizing the selections according to each customer’s past purchases.

- The email includes a limited-time discount code valid until midnight, creating urgency.

- You pair this email strategy with social media posts throughout Sunday, reminding followers to stock up for the week.

- In your online store, you prominently feature a “Weekly Essentials” section on Sundays, making it easy for customers to quickly add their regular items to their cart.

A targeted approach like this will align well with your customers’ habits, making your brand a natural part of their weekly routine.

Insight 2: External economic factors are impacting the food & beverage industry

Food & beverage brands are feeling the economic squeeze. Take a look at the evidence:

- Despite 86% of food & beverage companies expecting revenue increases this year, food & beverage is the least likely ecommerce vertical to report increased profits and margins.

- 56% of food & beverage brands have raised prices.

- 59% of consumers cite “higher prices” as the main reason they expect to spend more in this category.

These findings highlight a challenging environment. You’re caught between rising costs and price-sensitive consumers. So, you must perform a delicate balancing act. You must somehow maintain profitability without alienating your customer base.

The fact that consumers expect to spend more due to higher prices, rather than increased consumption, is particularly telling. It suggests that while customers are accepting price increases for now, they’re doing so reluctantly.

How to use this insight to thrive in the food & beverage industry

In times of economic pressure, your value proposition becomes even more critical. You need to clearly articulate why your product is worth the price.

Cereal brand Magic Spoon does this brilliantly. Their core value proposition is “high-protein, keto-friendly, gluten-free cereal with 0g of sugar.” But they don’t stop there. They translate this into emotional benefits with catchphrases.

Here, see how the brand’s website copy “Childhood classics. Grown-up ingredients” taps into nostalgia while highlighting the product’s health benefits.

Image source: Magic Spoon

By focusing on both functional and emotional benefits, Magic Spoon justifies their premium pricing. They’re not just selling cereal; they’re selling a guilt-free way to indulge in childhood nostalgia.

Your brand can use the following lessons from Magic Spoon’s approach:

- Identify your unique selling points. What makes your product special?

- Translate those points into customer benefits. How do they improve your customer’s life?

- Express these benefits in creative, emotionally resonant ways.

- Consistently communicate this value across all touchpoints—your website, packaging, ads, and customer service interactions.

Another way to use this insight to thrive in the food & beverage industry

Offering products at various price points can help you retain price-sensitive customers while still capturing higher-end sales.

Let’s say you run a brand known for premium, organic fruit preserves. To adapt to economic pressures, you introduce new product lines at different price points.

So, now you have:

- Essentials: a line of single-fruit preserves in smaller jars. Made with organic fruit but fewer exotic ingredients. Priced 20% lower than your main line.

- Classics: your existing premium line. No changes.

- Reserve: ultra-premium, limited-edition preserves featuring rare fruit varieties or unique flavor combinations. Priced 30% higher than classics.

This strategy allows you to:

- Retain price-sensitive customers with essentials.

- Maintain your core offering with classics.

- Capture additional revenue from less price-sensitive customers with reserve.

Insight 3: Food & beverage brands need to invest more in paid search and email

Food & beverage brands are hungry for new customers.

In our survey, 56% of retailers ranked acquiring new customers as their top marketing priority in 2024. Increasing average transaction price (37%) and driving customer engagement (37%) were next on the priority list.

To acquire new CPG ecommerce customers, your top marketing priority should be increasing investment in paid search and email marketing. Both channels have a strong influence on consumer purchase decisions in the space, according to our survey (79% and 60%, respectively).

Why are these channels particularly effective for food and beverage brands?

Paid search captures high-intent customers. When someone searches for “organic coffee beans” or “gluten-free snacks,” they’re most likely actively looking to make a purchase. By appearing in these searches, you put your brand in front of customers at the exact moment they’re ready to buy.

Email marketing, on the other hand, allows for highly personalized, direct communication with your audience. And according to our research, while food & beverage companies use email marketing the most compared to other strategies such as influencer marketing and broadcast advertising, the number is still fairly low at 35%.

How to use this insight to thrive in the food & beverage industry

Make your email marketing as impactful as possible by segmenting your audience. You can segment your email list based on purchase history, preferences, or browsing behavior, then tailor your messages accordingly.

This personalization is crucial in the food & beverage industry, where tastes and dietary needs vary widely, because it empowers you to create engaging email marketing content specific to your products.

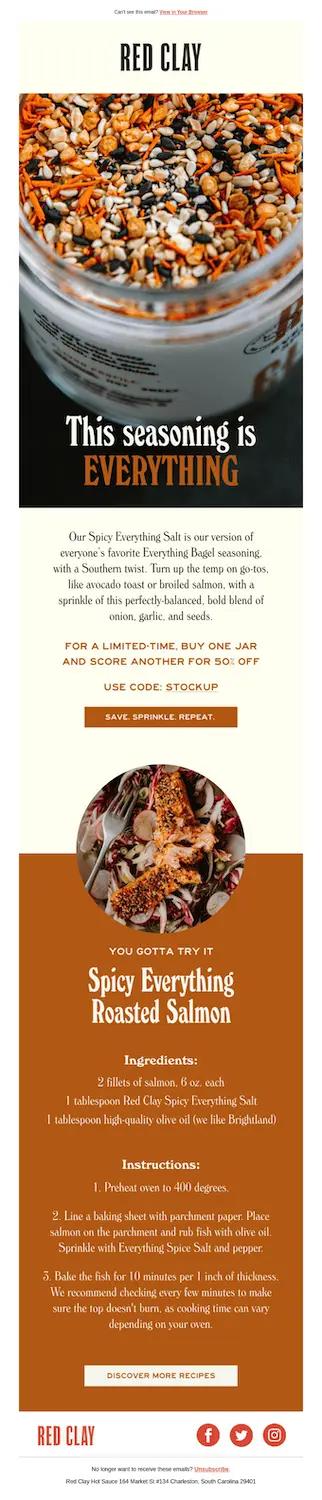

Here, Red Clay Hot Sauce provides an excellent example of showcasing products in creative, enticing ways.

Image source: Really Good Emails

In this email, Red Clay includes an offer for 50% off your next jar when you buy a jar of the brand’s spicy everything salt. But it doesn’t stop there. It also includes a recipe for roasted salmon that uses the product in question. It’s a genius way to generate demand by tying it to desire.

This strategy works on multiple levels:

- It provides an immediate incentive (50% off) to make a purchase.

- By including a recipe, it shows customers how to use the product, reducing potential hesitation about buying an unfamiliar item.

- The recipe creates desire by painting a vivid picture of a delicious meal the customer could make.

- It positions the spicy everything salt as a versatile kitchen staple, not just a one-off purchase.

You can adapt this approach to your own CPG products.

For instance, if you sell organic teas, your email could feature a limited-time discount on a new flavor, along with recipes for tea-infused desserts or a guide to the perfect afternoon tea ritual.

Another way to use this insight to thrive in the food & beverage industry

Integrate your paid search and email marketing strategies to create a cohesive customer journey.

Let’s say you sell artisanal cheese. Here’s how this might work for you:

- Paid search campaign: You run ads for your bestselling artisan cheese box targeting keywords like “gourmet cheese gift.”

- Landing page: The ad leads to a product page with a pop-up form offering a 10% discount in exchange for an email sign-up.

- Welcome email: New subscribers receive a welcome email showcasing your cheese selection and the story behind your sourcing process.

- Follow-up emails: You send a series of emails educating subscribers about cheese pairings, hosting cheese tastings, and featuring customer reviews of the artisan cheese box.

- Retargeting: You use the email addresses you’ve collected to create a custom lookalike audience for social media ads, reinforcing your message across channels.

This integrated approach ensures that once you’ve captured a potential customer’s attention through paid search, you have multiple touchpoints to nurture them toward a purchase.

Leveraging both paid search and email marketing in this way allows you to not only acquire new customers, but also build lasting relationships that drive repeat purchases and brand loyalty.

Insight 4: Food & beverage customers are more willing to brand hop

Here’s another challenging trend for food & beverage brands: customers may be willing to switch brands for better deals.

Price (79%) and quality (78%) emerge as the top factors influencing purchase decisions in this space, far outweighing factors like brand reputation (41%).

This trend has significant implications for brand loyalty in the food and beverage sector. It suggests that customers are less likely to stick with a single brand out of habit or emotional attachment.

Instead, they’re actively comparing options and choosing based on perceived value. This shift puts pressure on brands to continuously prove their worth and differentiate themselves beyond just price.

How to use this insight to thrive in the food & beverage industry

In a market where brand-hopping is common, your goal is to create a brand identity and experience so unique and valuable that customers think twice before switching.

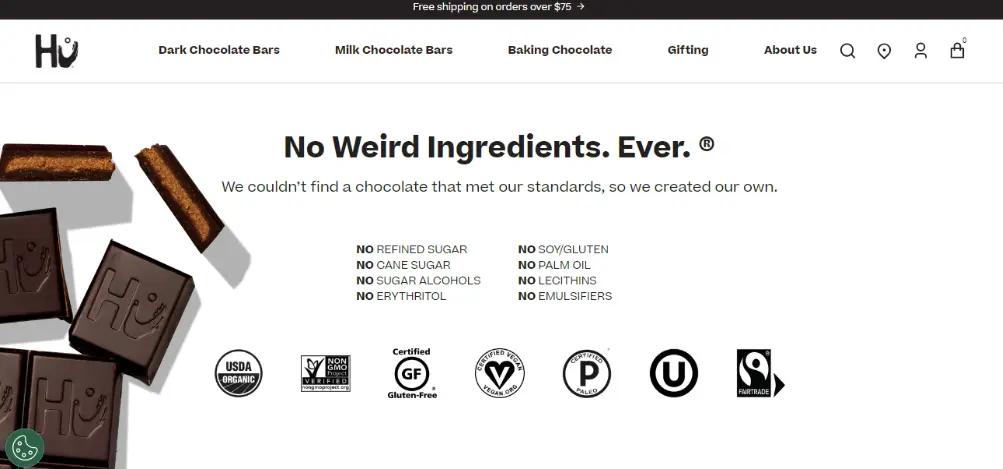

For instance, in the competitive chocolate market, Hu Kitchen has distinguished itself by focusing on “ultra-clean” ingredients—as seen in this web copy, with its emphasis on “No Weird Ingredients. Ever.”

Image source: Hu Kitchen

Hu Kitchen’s paleo-friendly, gluten-free, and soy-free vegan chocolates appeal to health-conscious consumers and those with dietary restrictions.

The brand’s minimalist packaging and emphasis on ingredient transparency have helped create a premium image for a traditionally commoditized product.

By carving out a unique niche, Hu Kitchen gives customers a reason to choose their brand beyond just price or general quality.

Another way to use this insight to thrive in the food & beverage industry

Subscription models can help prevent your customers from jumping to a competing CGP ecommerce brand, all while boosting recurring revenue. They encourage low-effort repeat purchases and foster long-term customer relationships.

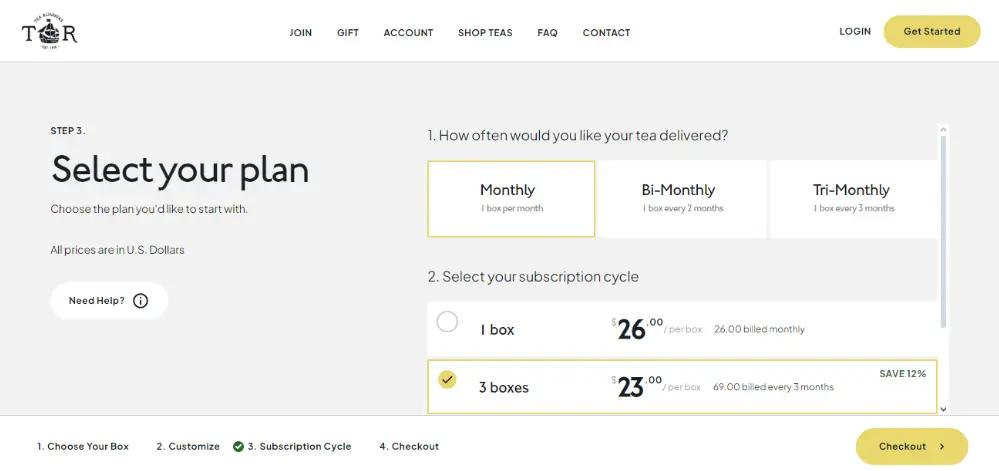

Take Tea Runners, for example. They offer a subscription model for tea enthusiasts where customers choose from various subscription options, selecting delivery frequency and tea types.

Image source: Tea Runners

Tea Runners offers exclusive discounts to subscribers compared to one-time purchases, incentivizing long-term commitment. And the subscription option empowers customers with unique control and flexibility: they can easily manage their subscriptions, including pausing or modifying plans.

By implementing a similar model, you can turn frequent shoppers into committed, long-term customers.

Sink your teeth into the full report

We’ve explored the key insights for the food & beverage industry from the 2024 state of ecommerce report. But these insights are just the appetizer.

The full report serves up a feast of data and trends. It’s packed with actionable insights to help you navigate challenges, seize opportunities, and ultimately plan for success in today’s ultra-competitive ecommerce market.

Want to dive deeper into the state of the ecommerce industry?

Get the report