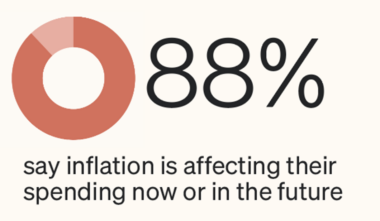

Consumers are feeling inflation, hard

Consumer economic outlook is cautious. Less than a third of consumers expect the job market, the political climate, the stock market, or interest rates to improve by the end of the year, and inflation is affecting current and/or future spending habits for the vast majority. Most consumers are spending more on essentials as the cost of goods and services continues to rise, while discretionary spending holds fairly steady.