Editor’s note: This article features insights and perspectives on what’s happening within the ecommerce industry in the United Kingdom (UK) and the European Union (EU).

Just like some of you have created frequently asked questions (FAQ) pages about Brexit for your customers, my colleagues and I wanted to do the same for you to help you navigate Brexit’s impact on ecommerce and the questions we’ve heard from the community these past few weeks.

I’ve written brief answers to each of them, and—where possible—I’ve linked to additional resources you might find helpful as further reading.

This handy guide to ecommerce marketing in a post-Brexit world is just for you, so tweet us @Klaviyo if we’ve missed any of your burning questions.

Okay, are you ready? Sitting comfortably? With a suitable drink in hand? Excellent, let’s dive in!

What does Brexit mean?

The term “Brexit” is short for “British exit” and refers to the UK’s departure from the EU, its single market, and customs union.

The UK officially left the EU on January 31, 2020, and was in a transition period until January 1, 2021, while the two sides continued negotiating a deal.

Both parties agreed upon a deal on December 24, 2020, which came into effect on January 1, 2021.

While the UK can continue trading with the EU, new rules apply (more on these shortly). The UK can also now set its own trade policy and negotiate deals with other countries around the world.

Recommended reading: Brexit – What you need to know about the UK leaving the EU

What businesses and sectors are affected by Brexit?

The short answer is most, if not all, businesses and sectors are affected by Brexit. I’ll explain.

The UK is no longer part of the EU’s customs union and single market, so the UK government can now agree on trade deals with countries outside of the EU, such as with Canada and Japan.

Agreements like this affect global trade, and it’s possible more trade deals—such as with the US—will follow in the coming months and years, as well.

Ultimately, Brexit impacts any business that handles international imports and/or exports. Whether it’s because of changes to Value Added Tax (VAT) laws, customs charges and thresholds, border checks, general process changes, or otherwise.

Brexit also directly impacts specific sectors within the ecommerce industry, such as food and drinks businesses (because of the EU’s food import restrictions), and luxury goods businesses (because of the value of their goods exceeding the new VAT thresholds).

Recommended reading: What Was Brexit, and How Did It Impact the UK, EU, and the US?

What are the key points of the Brexit trade deal that impact ecommerce businesses?

Because the UK is no longer part of the EU’s single market and customs union, you’ll need to follow different rules when importing and exporting to and from the EU—and vice versa.

You’ll have additional paperwork and customs checks at borders now, and the EU has restrictions on importing certain items, such as cheese.

These new rules and regulations affect the supply chain, fulfillment process, and what your customers need to know.

Extra customs checks at borders, for example, mean potential shipping delays. Meanwhile, changes to VAT and customs charges mean you may need to assess who covers these additional costs—you or your customers.

You may also not be able to hold or register an .eu web domain anymore since EURid has reserved these for EU residents and citizens only. This means you may now face additional costs for purchasing new domains or for general website admin.

Recommended reading: Brexit – What are the key points of the deal?

How does Brexit affect my customers?

Although Brexit impacts businesses a great deal, Brexit also affects your customers.

There’s still an element of uncertainty surrounding the recent changes and what exactly it means going forward.

Not to mention some customers—particularly in Northern Ireland—are experiencing stock shortages, while others are facing increased costs when ordering from their favorite brands.

And I haven’t even mentioned COVID-19 yet.

My point is: Your communications and marketing efforts might need an extra dose of sensitivity and empathy right now.

Recommended reading: How to communicate with empathy post-Brexit

Will business costs change now that Brexit’s happened?

If you import and export into or from the EU, then—in a word—yes, your business costs will change. Specifically, changes to tax rules and customs processes could affect your costs.

If you decide that your retail prices also need to change because of this, then you may want to communicate price changes with your customers so they’re on the same page.

Recommended reading:

- Brexit and Ecommerce Marketing: 13 Communications Tips to Drive Customer Loyalty

- How to Communicate with Empathy Post-Brexit

How will Brexit affect imports, exports, and shipping?

As you might imagine, Brexit impacts imports, exports, and international shipping a fair amount.

There are new customs regulations to follow, which means additional paperwork to fill out, such as customs declaration forms, while additional border checks can cause delays.

You’ll also need to think about who will pay additional customs charges. Essentially, you have two main options: “Delivery Duty Paid” (DDP)—where you’ll handle customs charges for your customers, or “Delivered Duty Unpaid” (DDU)—where your customers handle any additional import costs.

It’s completely up to you which one you choose as only you can say what’s best for your business and its profitability.

You may also need an Economic Operators Registration and Identification (EORI) number for shipping to and from the EU (more on this below).

Recommended reading:

- Brexit: A Complete Guide to Shipping and Ecommerce

- DDU vs. DDP: Differences in Terms of Shipping

- Avoid the Brexit import VAT trap – Delivered Duties Paid DDP

What’s an EORI number and do I need one?

An EORI number is a unique identification code, which is used to register and track imports and exports into and out of the EU.

Any business—now including British businesses—that import or export physical goods to the EU needs one, unless your business is based in Northern Ireland and you’re only sending goods between there and the Republic of Ireland.

You can apply for an EORI number online via the UK Government website, which also includes information on what to do if you already have an old EORI number and whether you need to change it.

What do I need to know about post-Brexit trade tariffs?

As part of the trade deal agreed between the UK and the EU, tariffs typically don’t apply. But there’s one important exception.

“A product will attract tariffs if more than 40 percent of its pre-finished value is neither of British nor EU origin, from Japan, for example,” says an article on the Guardian website.

Recommended reading: Tariffs on goods imported into the UK

What do I do if my courier stops delivering to some countries?

If your courier stops delivering to certain countries, speak with your third-party logistics provider (3PL) and/or courier to find out more about what the holdup is and how this will impact your business and your customers.

Once you know more about the situation, consider emailing your customers and subscribers in the affected countries. You can do this easily by segmenting based on subscriber location.

You might also want to update your shipping policies if delays and other delivery issues are ongoing. You could also consider using a different courier or shipping method whilst you resolve issues with your usual one.

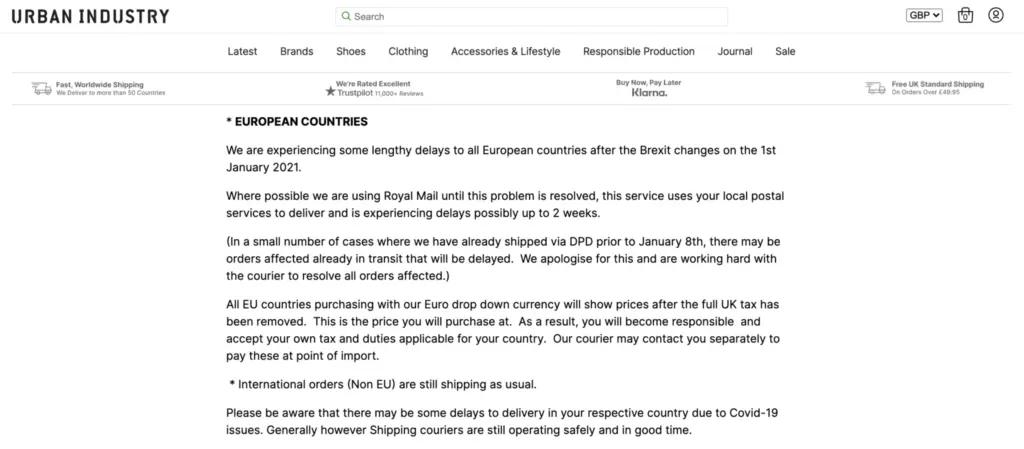

For inspiration, check out what the outdoor and streetwear apparel brand, Urban Industry wrote on their shipping policy page when they had courier issues last month:

How are returns and exchanges impacted by Brexit?

Just like with your outbound parcels, returns and exchanges also face customs checks. But the onus is on your customers to complete the customs declaration forms correctly—or you could face fees for parcels held at the borders.

Some businesses have circumvented this by using fulfillment centers in the EU as return hubs, while others provide their customers with commercial invoices that their customers can use when returning an item.

However you decide to handle returns after Brexit, consider noting the process in your returns and exchange policies, post-purchase emails, and packing notes.

Recommended reading: Preparing Your Returns Proposition For Brexit

What information should I share with my customers about Brexit?

Most agree that sharing helpful information on how customers can continue shopping with you is ideal for building long-term brand loyalty and strong customer relationships.

Consider sharing important company updates, any process changes you think your customers need to know about, and sending proactive communications when things don’t quite go according to plan.

Recommended reading:Brexit and ecommerce marketing: 13 communications tips to drive customer loyalty

What information should I share with my employees about Brexit?

Your employees need to know anything that your customers know—whether that’s supply chain issues, policy updates, or any other important company updates.

That way, if a customer gets in touch, they’ll get a speedy, coordinated, and up-to-date response every time.

If applicable, you might also need to check that any EU nationals you have working for you are up-to-speed with the EU Settlement Scheme and how this affects them and their work permits.

How can I improve brand loyalty after Brexit?

There are lots of things you can say and do to encourage loyalty among your customer base—before Brexit, post Brexit, and beyond.

But if I could dispel my advice down into just a few words, then I’d say: Be proactive, honest, and transparent in your communications, and remember that empathy breeds trust.

What’s the Internal Market Bill, and how does it affect ecommerce?

The Internal Market Bill, or the United Kingdom Internal Market Act 2020, enables UK-based businesses to continue trading between all four UK nations.

This bill particularly impacts manufacturing and food and drink businesses as it influences product labeling, animal welfare, energy efficiency, and environmental issues, such as avoiding single-use plastic.

Recommended reading: UK Internal Market Bill becomes law

Have data privacy laws changed now because of Brexit?

I’m not a lawyer (there goes that childhood dream!), so the following is just information to be aware of. Always seek official legal advice before making any changes or decisions.

You’ll likely already know about the EU General Data Protection Regulation (GDPR), which came into effect in 2018 and affects businesses marketing to customers within the EU.

The UK now also has its own version of the GDPR.

In short, there aren’t many material differences between the two, so the chances are that if you’re GDPR-compliant within the EU, then you’re also likely compliant within the UK. Confirm this with your legal counsel to be completely sure, though!

Beyond the GDPR, you might also want to read up on Privacy Shields—previously known as Safe Harbor Agreements. These refer to personal data transfers between the EU and further afield. The UK is currently awaiting an adequacy decision from the EU, so this likely won’t impact you for at least a few months.

Recommended reading:

- Using personal data in your business or other organization

- Data Protection after the end of the transition period

What’s the Ecommerce Directive, and how does it affect my ecommerce business?

“The Ecommerce Directive allows European Economic Area (EEA) online service providers to operate in any EEA country, while only following relevant rules in the country in which they are established. This framework no longer applies to UK providers as the UK has left the EEA and the transition period is over,” states the UK government website.

That means there may be new rules to follow if you operate within an EEA country. Familiarize yourself with this article and seek legal advice from your counsel to check whether any new rules apply to your business.

Is cross-border trade viable right now, especially post-Brexit?

Only you and your business advisors can fully answer whether cross-border trade is viable, since your profitability in foreign markets might differ from other businesses.

But what I can share are some examples of how other businesses are handling cross-border trade right now as inspiration for your own strategy.

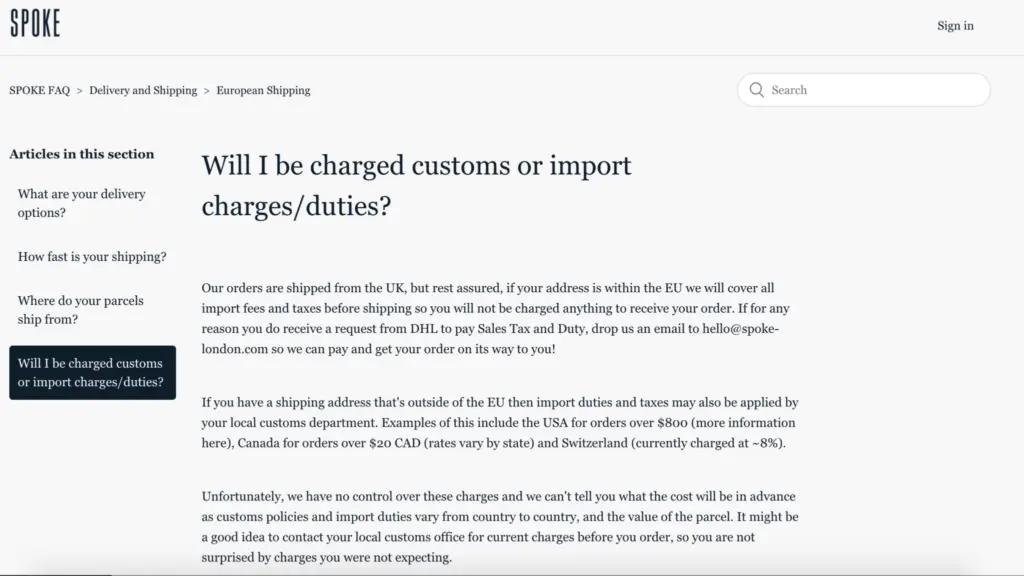

SPOKE, a menswear brand based in London, says that they’ll cover all import fees and taxes for their EU-based customers:

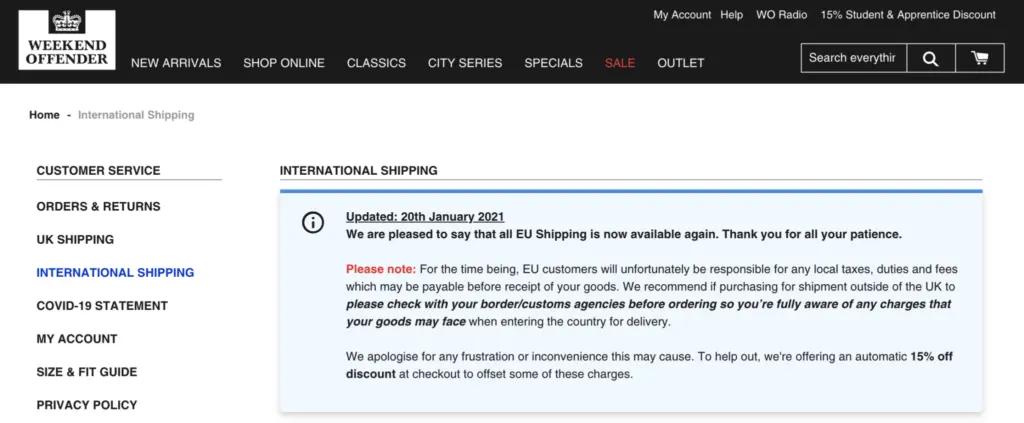

Meanwhile Weekend Offender, another UK-based apparel brand, states customers are responsible for import duties, taxes, and fees. But the brand offers a 15 percent discount to help offset some of these charges:

And finally, Cefinn, a London-based fashion label, specifically calls out their use of DDP on their Brexit page, so customers are aware no additional fees or taxes should apply when ordering from them:

Rachel Bowditch, a business management consultant specializing in Brexit and ecommerce, has also recently spoken publicly about the potential opportunities that Brexit can offer some businesses—particularly if your business can fill gaps left open by others. You might find her videos—such as this one—worth a watch.

Are there any other key Brexit dates I need to be aware of?

At the time of writing, there are three important Brexit dates to be aware of:

- April 1, 2021: The three-month customs grace period ends between Northern Ireland and the rest of the UK.

- July 1, 2021: The ability to delay customs declarations and payments for import duties no longer applies. You’ll need to import goods under either the temporary storage or pre-lodgement model and make safety and security declarations for any imports from the EU to the UK.

- July 30, 2021: The final deadline for European nationals and their family members living in the UK before December 31, 2020, to apply for status on the EU Settlement Scheme.

Where can I learn more about Brexit and its impacts on ecommerce businesses?

There are lots of resources available to help you learn more about Brexit and its impacts on ecommerce businesses.

Here’s my pick of the best Brexit advice for small businesses:

- Avalara’s Brexit and business resources hub

- The UK Government’s Brexit resources hub (it includes free webinars and guidance specifically for the retail sector)

Navigating this new post-Brexit world together

Phew! That was a lot of information about Brexit—I hope you found it useful.

Are you ready for your post-Brexit action plan? If you haven’t already ticked them off, here are some important steps to take right now:

- Get an EORI number if you need one

- Check what additional paperwork and customs declaration forms you need

- Check your shipping, returns, and exchange policies are all up-to-date

- Update your automated emails—if needed—to align with these policy updates

- Read up on the new VAT rules

- Decide how you’ll approach customs charges and update your customers accordingly

- Read up on the UK GDPR to check you’re compliant with the rules and regulations

- Check that any EU nationals working for you are up-to-speed with the EU Settlement Scheme and work permits

- Find out if you have new rules to adhere to related to the Ecommerce Directive

And finally, don’t forget to breathe!

There have been a lot of changes recently and it can be tough to get your head around all the new rules. All of us here at Klaviyo, alongside our community and partners, are on hand to help.

Do you have any questions that aren’t listed above? Tweet us @Klaviyo, so we can add them.

Grow your business on your own terms with Klaviyo

Sign up